The digital transformation has facilitated old modes of trade and business models and enabled the creation of entirely new ones. This piece suggests a classification of the modes in which trade is conducted as it progressively shifts into the digital or digitally-facilitated realm. The authors further identify the areas where resistance has been encountered and introduce the approaches taken by the major digital economy players in framing regulations for digital and digitally-enabled trade.

Net neutrality, data localisation, privacy, and conditions of competition are just a few of the regulatory battlegrounds in the digital trade wars that have been brewing with the digital transformation. The war is global in scope and the stakes are high. The opening manoeuvres include a proclamation by the United States that data must be free to flow across borders and a move to dismiss net neutrality, advantaging its Hanseatic League of superstar firms that dominate the Cloud and the Web. This has been countered by China with its Great Digital Firewall, behind which, ever playing the long game, it is grooming its own national champions. The European Alliance, although distracted by political fissures, has moved to tax income flows generated in the digital realm while it formulates strategies to defend its interests – if only it could define exactly what those are. The talk goes on. The small open economies meet in council to weigh their options for alignment. And, yes, there is a rag-tag network of digital warriors, whose pens are mightier than their swords, mobilising to defend the threatened Digital Commons from Imperial enclosure and thereby to ward off the dystopias that litter Netflix.

The plot thickens and we’re only just getting started. To facilitate the analysis of this conflict, we seek in this article to lay out its structure.

The theatres of the digital trade wars are the modes of digital and digitally-enabled trade; we propose a taxonomy of these modes to organise the dispatches from the fronts.

The battleground issues are defined by the barriers to digital trade; we review the list of areas where trade resistance has been encountered and where trade agreement intervention strikes have been called in.

Against this background, we contrast the tactics of the major players as revealed in their framing of regulations for digital and digitally-enabled trade in the regional trade agreements in which they are engaged. And we consider the prospects for a WTO-brokered digital trade peace, with agreed rules of the road and opportunity for inclusive growth in the knowledge-based and data-driven economy that the digital transformation is midwifing into being.

The modes of digital and digitally-enabled trade

The digital transformation has facilitated old modes of trade and enabled entirely new modes. Digital disruption is being felt across all the modes: digital versions of products or services compete with physically embodied versions; and digital distribution/facilitation business models compete with traditional distribution business models. The issues raised, potential responsive measures, and consequences for trade – and the value proposition of commitments in trade agreements – vary across the modes.

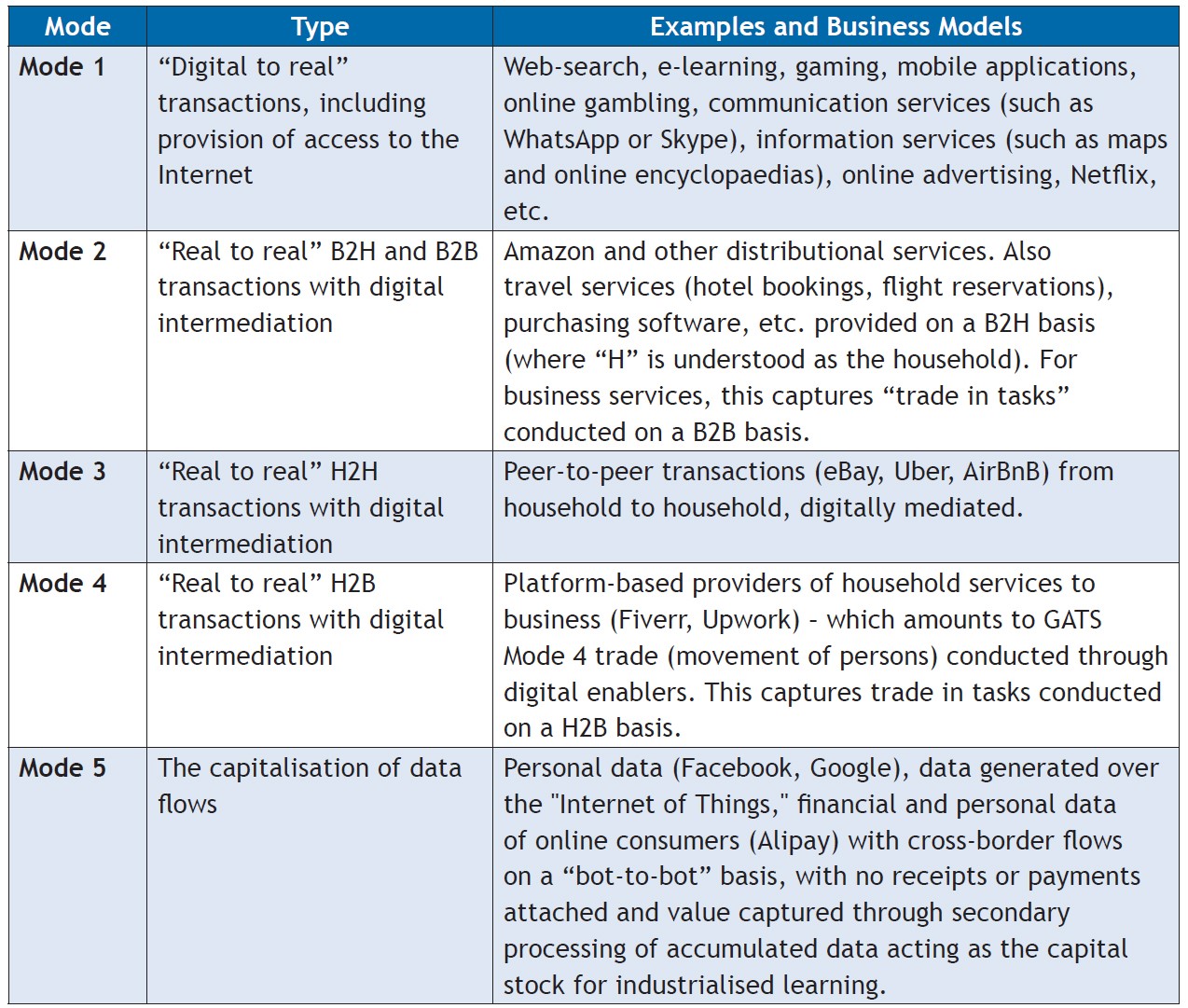

As there does not yet appear to be a generally accepted way of classifying the modes of digital and digitally-enabled trade, we suggest the following classification of transactions based on delivery mode and the nature of the parties to the transactions to help organise the analysis.

Table 1. Modes of digital and digitally-enabled trade

Note: B2B = business to business; B2H = business to household; H2H = household to household

The scope of Mode 1 trade is confined to digital products that are either downloaded, accessed through streaming, or accessed from the cloud. It is conducted through business models such as Netflix, predicated on the modus vivendi of the millennial generation, which prioritises access over ownership. The first issue that arises for Mode 1, given the convention that trade occurs between countries, concerns the location of the source and destination country. There is no obvious answer to this, since the cloud has no specific earthly location, value chains in business services may be globally distributed, and transactions can take place anywhere in the world – for example, a Canadian can download an online article while travelling in the United Kingdom, from a server located in Korea, facilitated by a US-based corporation. Server location as a guide to source country is compromised by the Software or Infrastructure as a Service (SaaS or IaaS) business models. Mode 1 trade is truly company-based trade, not country-based trade.

Mode 2 covers digitally-enabled trade in goods and services. This is conducted through the “bricks and clicks” business model of firms like Amazon, which competes head-to-head with established distribution models. Such trade is captured in principle by traditional statistics on international trade although use of this mode likely compromises the quality of product classification and raises questions about the relevance of free trade agreements since these are not designed to facilitate retail cross-border transactions. Provision of “real” non-digital services through the Internet also falls into this mode of supply. These include, for example, travel services, such as hotel bookings or flight reservations, and purchasing software, as well as out-sourced “trade in tasks,” the driver of the “second unbundling”.

Mode 3 consists of peer-to-peer transactions. It is intermediated through business models of firms such as eBay, Uber, and AirBnB. This mode of trade intensifies the utilisation of (and thus increases the returns to) assets already owned by households. However, it disintermediates established businesses. This mode raises new issues as it transfers rents, challenges or compromises established taxation and regulatory regimes, and may not be captured by systems set up to collect trade statistics.

Mode 4 in digital trade corresponds to Mode 4 trade under the General Agreement on Trade in Services (GATS) and captures “trade in tasks” from households that is digitally mediated. A relatively new model of freelance networks generates this mode of supply. Such platforms as Fiverr and Upwork connect service providers to businesses across borders, thus creating a H2B transaction environment – the international extension of the “gig economy,” which can alter traditional labour markets and impact competition conditions in factor markets. For example, a German start-up company may wish to hire the cheaper services of a Philippine website designer through Fiverr, rather than hiring a German worker.

Categorising Mode 5 is more complicated. Data flows are not for the most part digital transactions because, except where data is a product, there is no payment and no paper trail of invoices and receipts. These flows are, however, integral to, and essential enablers of, digital and digitally enabled trade in all four of the modes above. In a trade facilitation sense, they are not new – electronic data interchange (EDI) flows have long been part of the institutional framework of international commerce. What is new in the data-driven economy is the compilation of data into databases that are the essential capital in the age of artificial intelligence (AI). These data include most prominently the personal data compiled by platforms such as Facebook and Google (in what is effectively barter exchange for “free” services to platform users), which underpins their vast market capitalisation, which in turn is premised on their ability to exploit the search, consumption, transaction, and location data to capture advertising expenditures. Similarly, payments systems integrated with other services, such as China’s Alipay and Alibaba, can shape markets by providing tailored advertising, altering the competitive landscape. More broadly, of relevance across a wide swathe of industries, data generated over the “Internet of things” (IoT), coupled with machine learning technologies which are being introduced on an ever-wider scale, enables process optimisation and potentially other advantages that at this early stage can only be sensed. It is the capitalisation of data which drives commercial gains and thus represents the value proposition of Mode 5 digital trade. This is one sense in which data is different. Another is that, while innovative firms can work around others’ patents, they cannot work around lack of access to data to train their own algorithms. Access is the key issue. And thirdly, insofar as AI represents the industrialisation of learning, it promises the proliferation of superstar firms and rising concentration.

Barriers to digital trade

Since digital trade has emerged in the highly open post-WTO era and through new enabling technologies for which trade restrictions had not yet had a chance to evolve, there is less of a need to liberalise digital trade, as opposed to the need to prevent the adaptation to the digital realm of trade protections prevalent in the pre-existing physical modes of trade – viz. the WTO moratorium on application of tariffs to electronic transmissions. At the same time, issues are flaring and triggering regulatory pushback in many forms. Table 2 provides a preliminary categorisation of the frictions and barriers that have emerged from this tension, based on business lobbying interventions in the area of e-commerce and data privacy, and on government policy statements.

Table 2. Alternative categorisations of barriers to digital trade

Note: This table is a shorter version of the original in the working paper.

Source: ECIPE, Business Europe, USTR, and Congressional Research Service.

The first four categories are new to the digital realm:

Frictions in the enabling environment are relevant primarily to Mode 1 trade as they have the effect of compromising market access and conditions of competition for digital products. As they are also highly relevant for the ability to capture data, they affect Mode 5 as well.

Technical trading restrictions and technology barriers are relevant to Modes 1 through 4 as they affect the digital intermediation of transactions and can act as technical barriers to trade. The former have a “horizontal” characteristic, while the latter appear to be more specific to individual companies and proprietary technology.

Data localisation requirements, as a frictional cost issue affect Modes 1 through 4; as the basis for industrial policy in the AI age, these are fundamental to Mode 5.

The second four categories of frictions are well-known from analogues in the physical realm (notably, they are all missing from the more tightly focused USTR list).

IP rights are cross-cutting issues across all modes

Establishment and fiscal restrictions primarily affect Modes 1 through 4 as they impact on commercial transactions.

SOE and procurement issues are likely to be fundamental issues to Mode 5, since access to data is premised on access to projects and customers.

In the latter regard, we are likely to see commercial approaches in the physical realm stood on their head: where companies formerly made capital investments in order to capture projects and customers, in the digital realm they are likely to bid low on projects to gain access to data for its capital value. The announcement by the Chinese firm Baidu that it would give away its software for self-driving cars in exchange for the data generated is an extreme form of this inversion. The fight for procurement opportunities in the IoT world is likely to be intense.

The protagonists

Circa 1980, when technological conditions were steepening economies of scale and increasing the scope for product differentiation based on quality, new theoretical contributions captured the implications: these included “new trade theory,” the economics of superstars, and strategic trade policy. At that time, the potential for capture of international rents implicit in these conditions gave rise to trade wars in sectors like dynamic random access memory chips (DRAMs) and aerospace. The main players were the United States, Japan, and Europe.

The digital transformation features these effects on steroids: economies of scale in the digital realm are extreme as marginal costs of serving additional customers fall to effectively zero, and quality advantages can lead to near total market dominance. The conditions are conducive to strategic trade rivalry and it has again emerged. This time around, the United States and Europe are joined in the main ring by China.

The United States and Europe share a broadly similar vision about the organisation of markets, but the United States has a massive first mover advantage and naturally seeks maximum openness to exploit the benefits. For Europe, having lost the lead to the United States notwithstanding its Single Digital Market (DSM) strategy, the cost-benefit analysis leads to an emphasis on minimising the adjustment costs and risks of the digital transformation. It becomes the regulatory champion. China, while playing catch-up, has a numbers advantage and is exploiting that to accelerate its progress up the learning. For data analytics, numbers are the I Ching and China’s natural incentive is to restrict access to its own data.

Each country is playing the hand its been dealt. The European Union-United States Trade Principles for Information and Communication Technology Services set out broad commitments to:

Open networks, network access, and use on a technologically neutral basis;

Free flow of information internally and across borders;

No requirement for ICT service suppliers to use local infrastructure or to establish a local presence as a condition of supplying services; and

Competitive access to markets in authorisations and licenses.

However, where the US approach as instantiated in the Trans-Pacific Partnership (TPP) carves these commitments into stone with prescriptive and legalistic text, the EU approach in the Canada-EU Comprehensive Economic and Trade Agreement (CETA) is silent on data localisation and emphasises privacy. Moreover, a rift is emerging with the US move to dismiss net neutrality, which the EU embraces. And, while both jurisdictions are concerned about tax base erosion, the US preference is to provide incentives to bring US-owned assets home while the EU’s is to withhold the taxes on income earned in Europe. The United States also naturally favours self-regulation over government regulation.

China does not share a commitment to open digital borders and rather claims sovereignty over its cyberspace, which it defends behind its Great Firewall. While China has signed onto e-commerce provisions (e.g. in the Australia-China free trade agreement), hard commitments do not go beyond those already made at the WTO and the commitment to base its laws on the UNCITRAL Model Law on Electronic Commerce 1996. The document that speaks the most for China’s position on rules regarding digital transactions is the Cybersecurity Law (CSL), which came into effect on 1 June 2017. The 79 articles of the CSL essentially make three major statements:

Physical data must be stored in Mainland China;

There are mandatory security inspections of equipment prior to installation; and

There is mandatory law enforcement assistance and data retention regulations.

In the Asia-Pacific Economic Cooperation Forum (APEC), the United States and China are engaged in ongoing discussions about cross-border privacy rules (CBPR). The framework works as follows: a participating economy appoints agents that certify companies that have compliant data privacy policies that would improve cross-border data flows. However, the United States and China appear to be on opposite sides in the understanding of what are compliant data privacy policies.

China’s strategy has succeeded – it does not resemble the North Korea of the digital economy. Rather, it has created a rapidly growing and technologically sophisticated “parallel universe” of domestic firms operating in the same space as the familiar Western companies. Some of these are world class market leaders: Alibaba, Baidu, and Tencent’s WeChat. China’s AI ambitions are high and the data density which feeds AI learning in China is unparalleled in the world – without going into details, its data generation today along numerous dimensions is as eye-popping as was its growth in goods trade post-WTO accession in the 2000s.

Can the WTO broker a digital trade peace?

Given the underlying economics of digital and digitally enabled trade, there is no obvious intersection of interests on which the three major digital trade economies could easily converge. The small open economies find themselves most closely aligned with the EU in the sense that their defensive interests (dealing with the fallout from digital disruption) outweigh their offensive interests (the capture of market share in the emerging knowledge-based and data-driven economy). Developing countries will have a menu of strategic options to choose from and the choice will depend upon digital ambitions (e.g. the BRICS will likely follow China’s example) versus expedient tactics to capture consumer benefits of access to the “free” content on the Internet and the use of the digital economy framework to participate in global commerce (the likely path of the smaller developing economies). This leads to the (reasonable) prognosis of increasing digital fragmentation at least in the near term (as already predicted), with digital trade conflict brewing centred on regulations (EU-United States) and on market access (United States-China).

The digital transformation and advent of AI promise pervasive disruption, affecting the conditions of competition within and between nations, the structure of industries, and income distribution. However, as the Stanford 2017 report on AI emphasises, “We are essentially ‘flying blind’ in our conversations and decision-making related to Artificial Intelligence.”

It would seem that we need to have the war to see the shape of a WTO-brokered peace. On the reasonable premise that an investment in dialogue might get us there sooner, with lesser economic costs, the group of interested small open economies should mobilise now – to talk. Taking a page from the “Really Good Friends of Services,” consideration should be given to forming an analogue “Really Good Friends of Digital Trade” to energise what has by all reports been a lacklustre formal dialogue in the WTO to date.

This post is an adaptation of an ICTSD paper by Dan Ciuriak and Maria Ptashkina entitled The Digital Transformation and the Transformation of Digital Trade. The paper was originally presented and discussed at the RTA Exchange Dialogue Digital Trade-Related Provisions in Regional Trade Agreements.

Dan Ciuriak is Director and Principal at Ciuriak Consulting Inc.

Maria Ptashkina is a PhD student at University Pompeu Fabra, Barcelona, and Bridges Graduate Fellow at ICTSD.